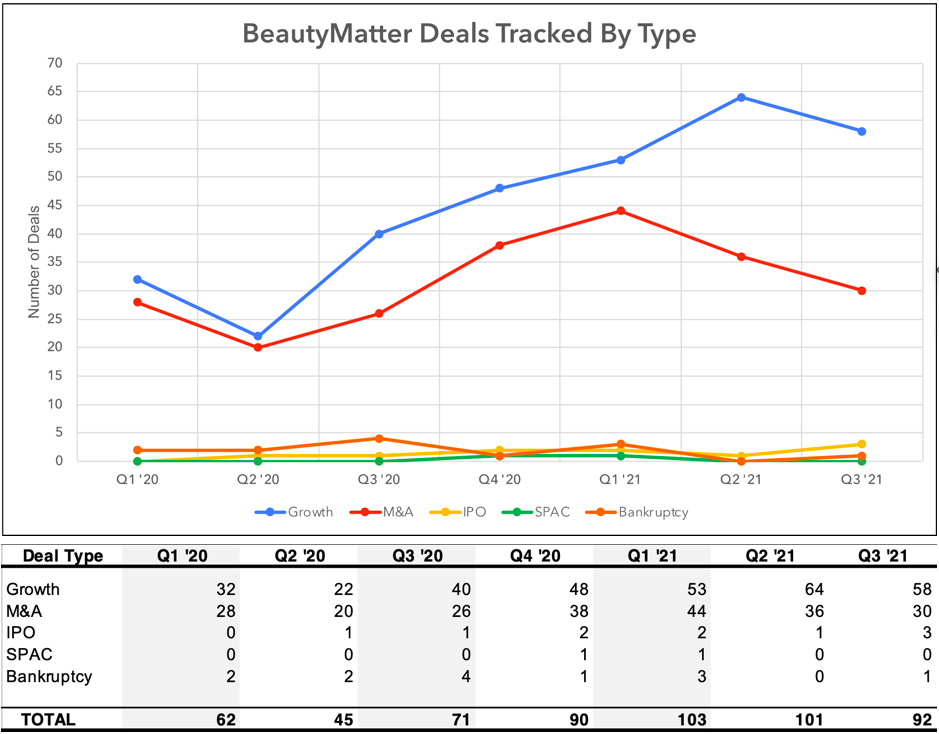

Beauty and wellness deal activity during the third quarter continued to show strength, with the BeautyMatter Deal Index tracking 92 transactions versus 71 during the third quarter of 2020, a 30% increase, year over year. Q3 year to date, BeautyMatter tracked 296 deals, with growth investments (seed, venture, minority stakes) comprising 56% of deal activity, and M&A (traditional mergers, acquisitions, and majority stakes) comprising 37%. Deal activity year to date in 2021 has already exceeded all of the deals BeautyMatter tracked during the full year of 2019 (275 deals). 2021 continues to be a banner year for beauty and wellness dealmaking.

When one digs below the surface, however, there is evidence of some small cracks in the beauty deal boom that has dominated much of 2021. Uncertainty seems to be the dominant force tempering the boom in the back half of the year, but much of it is likely to be temporary.

The overhang on third-quarter deal activity was primarily driven by, you guessed it, the lingering effects of COVID-19. The Delta variant emerged as a dominant headline during the quarter, putting a damper on the robust economic recovery many economists were predicting for the back half of 2021. With the Delta variant’s peak moving, albeit slowly, into the rear-view mirror and vaccination rates increasing (also more slowly than expected but, nonetheless, moving in the right direction), we could be in a position to see a burst of pent-up deal activity in the last few months of the year.

The Delta variant only accounts for part of the COVID-induced dealmaking frothiness during the third quarter. The world’s supply chains are suffering from a bout of “economic long COVID,” causing tremendous disruptions to many businesses in the industry. This has manifested itself in brands being sold out of bestsellers for months because they can’t get components, manufacturers short on key ingredients so they can’t ship product, and retailers unable to replenish because of product shortages. This has resulted in both top-line and bottom-line pressures for businesses. Some of this has been mitigated with price increases, which, to date, consumers have been willing to absorb, but headlines about disruptions to the beauty supply chain will likely be with us well into 2022.

No discussion about uncertainty during the third quarter would be complete without mentioning the potential for systematic market disruptions from potential changes to US tax policy or the potential disruption caused by Apple’s new iOS 14 and its impact on one of the mainstays of the beauty marketing playbook—digital advertising. All of this has resulted in dealmakers simply taking a breath. Deals are getting done, but perhaps investors are taking a slightly more cautious approach for the time being. Deal activity during the first half of 2021 versus pre-COVID levels in 2019 was up 100%. Deal activity during the third quarter of 2021 versus the third quarter of 2019 is up only 7%. Deal growth has slowed, but 2021 deal activity is still up versus pre-COVID levels.

A notable bright spot as we enter the final months of 2021 is that, despite the market uncertainty, consumer demand continues to remain strong. According to Jamie Dimon, CEO of JPMorgan Chase, “consumers are spending 20% more than they were pre-COVID” and according to research by Harris Williams, 49% of consumers are spending more on beauty and personal care in 2021 than in 2020 and 58% plan to spend more in 2022 than in 2020, which is an indication consumer spending is strong and growing. This consumer momentum bodes well for a strong fourth quarter and points to beauty investment opportunities as we head into 2022.

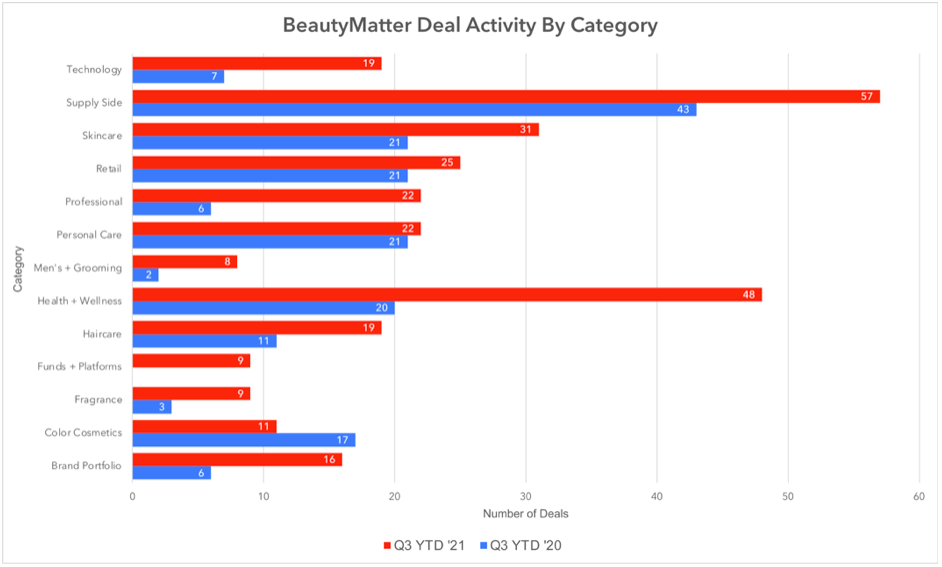

During the third quarter, dealmakers seemed to be making the bet that consumer demand would continue to yield returns at professional brands, skincare brands, and men’s grooming brands. In the third quarter of 2021 versus the second quarter, the number of deals involving professional brands was up 100%, skincare was up 33%, and men’s grooming was up 33%. Supply-side deals appear to be slowing, down 35% in the third quarter versus the second quarter; fragrance deals were down 67%, and color cosmetics continue to show weakness, down 25%. Across the board, color cosmetics remains the only deal category tracked by the BeautyMatter Deal Index that is down year to date in 2021 versus 2020.

The Fourth Quarter and Beyond

From where we stand today, the outlook for beauty and wellness dealmaking has never been brighter. Near-term uncertainty will likely keep dealmakers cautiously optimistic for now, but phenomena such as tax policy uncertainty could accelerate activity in the fourth quarter. Jeff Mills, Managing Partner at Main Post Partners, said, "Tax changes have definitely motivated business owners to consider an exit and puts pressure on transaction dynamics to close on specific timelines. We've seen a sharp increase in deal flow and getting something done before year-end is of paramount importance."

The performance of beauty and wellness brands during COVID has reinforced the resiliency of the category and will continue to drive valuation growth into 2022. Over the past decade, the sector has become a highly attractive, replenishable category, attracting an increasing number of venture firms, private equity firms, and specialized investment platforms, and giving brands access to a number of public market options. The has created a competitive market for investors and strategic buyers and has put upward pressure on valuations. Marissa Lepor, Vice President at consumer investment bank The Sage Group, told BeautyMatter, "With $1.9 trillion of dry powder globally, investors are increasingly competing for the best assets, driving up valuations of industry-disrupting businesses with strong and authentic brand stories, engaged consumers, and robust financial profiles. These assets continue to command unprecedented valuations and, as long as best-in-class brands continue to innovate, engage with, and expand their loyal fan base and scale profitably, more billion-dollar valuations are likely on the horizon."

The category interest has also spurred an increase in the early-stage investment market, with investors looking at smaller deals and starting funds to place bets on the next breakthrough beauty brands. Tech-focused VCs have started investing in early-stage beauty opportunities, and private equity funds have launched seed and venture funds to address gaps in the market. Greylock Partners, one of the most prominent VC firms in Silicon Valley, recently announced it would dedicate $500 million to seed rounds, making it the largest pool for early-stage start-ups ever. Swiftarc launched its fourth fund, Swiftarc Beauty, a $10 million fund that will support five to seven disruptive female founders in the beauty and wellness sectors. The fund made its inaugural investment in Alleyoop during the third quarter. And True Beauty Ventures, the early-stage investment fund founded by Rich Gersten and Cristina Nuñez, closed its first fund with more than $42 million to make between 10 to 12 investments. To date the fund has invested in Aquis and K18, Kinship, Feals, Crown Affair, Maude, and a pre-launch clean makeup brand. Ilya Seglin, Managing Director at Threadstone Advisors, feels the VC investment approach isn't appropriate for the beauty sector; however, the emergence of PE firms focused on small brands with sector expertise like Prelude, True Beauty Ventures, Waldencast, and CULT Capital are addressing a real need in the ecosystem.

With valuations high and investors flocking to the category, it seems that brands have options. Some will bypass private capital all together and, instead, tap the public markets, as Revolution Beauty, Olaplex, and European Wax Center did during the third quarter. Many are hiring bankers in droves to explore options or get a sense of current valuations. Only time will tell if deals will follow.